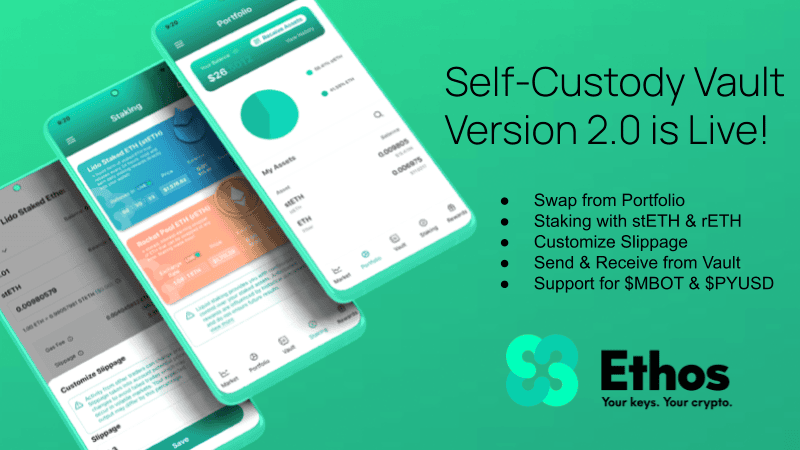

New! Version 2.0 of the Ethos Self-Custody Vault Now Live

Unleashing the Power of Self-Custody with Liquid Staking, Easier Swaps, new coins and more!

In the ever-evolving world of cryptocurrency, the Ethos Self-Custody Vault has just taken a leap forward with the release of its highly anticipated update 2.0. Available now on Android Google Play and the Apple App Store, this update brings many exciting features that are set to redefine the way you interact with your crypto assets. Let’s dive into what’s new and why you should be excited about it.

What's New in Ethos Self-Custody Vault 2.0

This update is packed with features designed to enhance your cryptocurrency experience and provide more control and flexibility over your assets. Here’s a quick rundown of what you can expect:

1. Liquid Staking

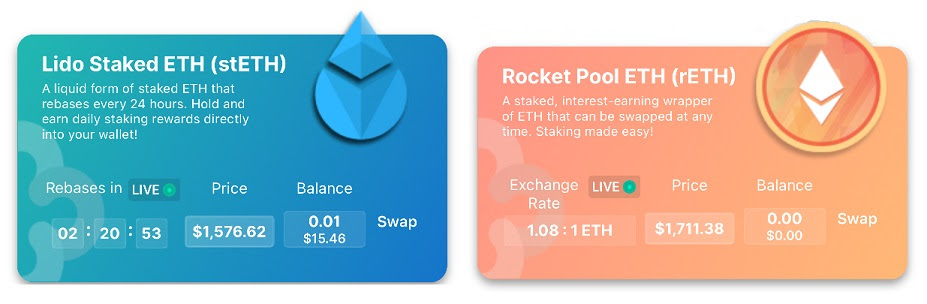

Liquid Staking is one of the standout features of this update. Through integration with Lido Finance and Rocket Pool, you can now stake stETH and rETH. This means your assets can earn rewards while remaining highly liquid. Staking with Lido and Rocket Pool offers a way to participate in Ethereum 2.0 without locking up your assets for an extended period. It’s a game-changer for those looking to balance rewards with liquidity.

For more information on stETH, check out How Lido Works. To learn about rETH, visit Rocket Pool 101.

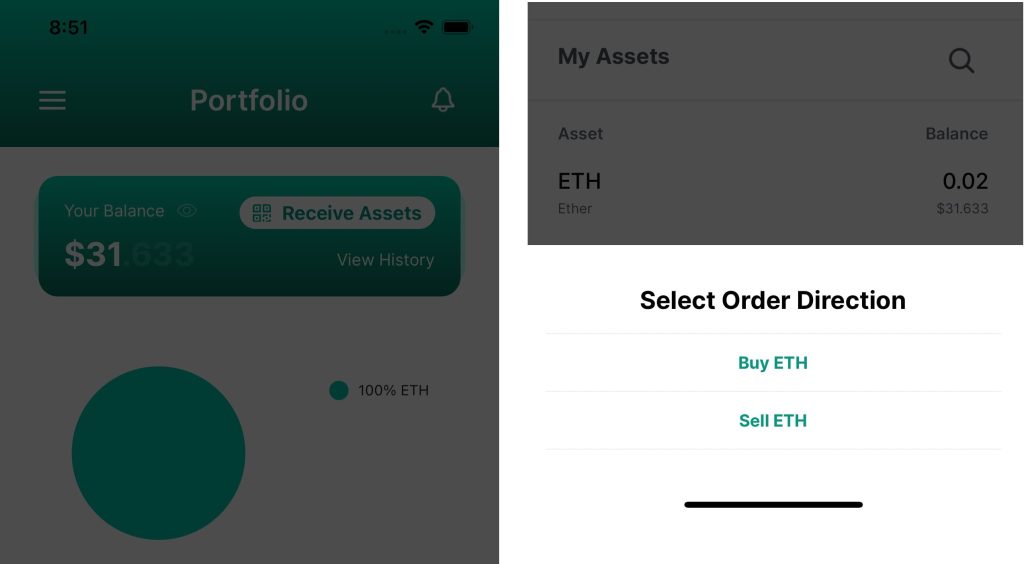

2. Swap from Portfolio and Send & Receive from Vault

Ethos has streamlined its user experience by allowing you to swap from your portfolio and send/receive directly from your vault. This simplification of actions within the app means fewer clicks and more efficient navigation. Managing your assets has never been easier.

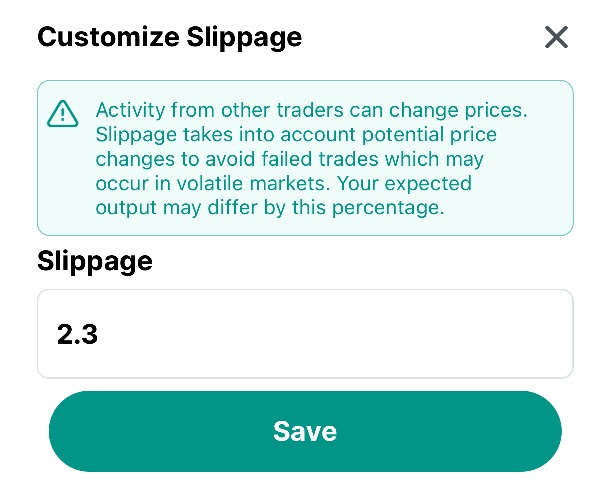

3. Customize Slippage

With the ability to customize slippage on swaps, you gain more control over your transactions. This feature empowers you to fine-tune your trades, ensuring that you get the best possible deal. To understand slippage and its importance, you can refer to an article on What is Slippage?

4. Support for $MBOT and $PYUSD

Ethos has expanded its supported coins to include two exciting additions:

-

MoonBot ($MBOT): According to The Crypto Professor, MoonBot is the fastest Telegram trading bot set to be released on the market. It outperforms all paid competitors and has been crafted by expert developers.

-

PayPal USD ($PYUSD): Issued by Paxos Trust Company, PYUSD is PayPal’s stablecoin designed for payments. It provides stability and reliability in the volatile world of cryptocurrencies.

How Does Liquid Staking Work?

The integration of Liquid Staking into Ethos Self-Custody Vault 2.0 is a significant step forward. But what does it mean for you? Liquid Staking allows you to participate in Ethereum 2.0 staking without the need to lock up your assets for an extended period.

In traditional Ethereum 2.0 staking, your ETH is locked until transfers become available in Ethereum 2.0 (Phase 1.5 or Phase 2), which could take some time. During this period, you can’t withdraw staked ether or rewards.

However, with Liquid Staking, you receive tokens like stETH and rETH, which represent your staked ETH balance on the Ethereum Beacon Chain. These tokens are liquid and can be traded, used in DeFi, or transferred, providing you with flexibility and control over your assets. When withdrawals become available on the Beacon Chain, you can convert these tokens back into ETH.

Why Liquid Staking Matters

The primary advantages of Liquid Staking include:

-

Flexibility: You can stake smaller amounts of ETH, unlike traditional staking, which requires a minimum of 32 ETH.

-

Liquidity: Liquid staking tokens can be traded and used in various DeFi applications, providing liquidity and earning potential.

-

Reduced Risk: Liquid staking mitigates the risk of penalties or loss of rewards that can occur in traditional staking if a validator is slashed for misbehaving.

-

Access to Rewards: You can earn rewards on deposits smaller than 32 ETH, giving you the opportunity to participate in staking even with a limited amount of ETH.

-

Alternative to Self-Staking: Liquid staking offers an alternative to self-staking or centralized exchange staking, allowing you to benefit from Ethereum 2.0 without the hassle.

About Lido Finance and Rocket Pool

-

Lido Finance: Lido DAO is a community that builds liquid staking technology for Ethereum. It allows users to stake ETH without maintaining staking infrastructure or losing the utility of their capital. Staking with Lido is expected to begin with Phase 0 of Ethereum 2.0. Liquid staking tokens like stETH represent your staked ETH balance and can be used while waiting for withdrawals to become available on the Beacon Chain.

-

Rocket Pool: Rocket Pool is a decentralized Ethereum Proof of Stake (PoS) infrastructure service designed to be highly decentralized and compatible with Ethereum 2.0 staking. It offers individuals, businesses, and DeFi applications the ability to provide their users with staking rewards on their ETH holdings without the complexity of running staking infrastructure. Rocket Pool makes staking accessible to a wider audience and offers a way to earn rewards without the need for a large initial deposit.

Download Ethos Self-Custody Vault 2.0 Now!

The Ethos Self-Custody Vault 2.0 update is a game-changer for cryptocurrency enthusiasts. With features like Liquid Staking, streamlined portfolio management, customizable slippage, and support for new coins, it’s a comprehensive upgrade that caters to both beginners and experienced traders.

Liquid Staking, in particular, opens up new opportunities for ETH holders, allowing them to earn rewards while maintaining liquidity. Ethos’ integration with Lido Finance and Rocket Pool provides a secure and flexible way to stake your ETH without the traditional constraints of locked assets.

To experience the benefits of Ethos Self-Custody Vault 2.0, click the button below or simply visit your app store, search for “Ethos Self Custody Vault,” and join the growing community of users who are embracing the future of cryptocurrency management.

Disclaimer: Cryptocurrency investments carry risks, and users should exercise caution and conduct their research before making any financial decisions.