$225M Recovered: A Huge Win for Crypto Users & Security

This week, the crypto community cheered a landmark announcement: the U.S. Secret Service, with crucial assistance from Coinbase, successfully seized over $225 million in stolen cryptocurrency.

This isn't just a record-breaking bust; it's a powerful statement about the evolving landscape of crypto security, and a reminder to always be cautious of who you interact with in the crypto space.

This blog will discuss details of the seizure, how scams take place, and how collaboration played a role in their success. We'll also offer essential tips to protect yourself, and look at how the crypto industry is collectively stepping up its game.

Pig Butchering Scams

This historic seizure, the U.S. Secret Service's largest crypto recovery to date, targeted funds stolen primarily through "pig butchering" scams.

Now's the point where you might ask:

"What's a pig butchering scam?"

"How are pigs and crypto even related?"

This type of long-term fraud gets its name from the practice of "fattening a pig before slaughter"—where scammers spend weeks or even months building trust with victims, nurturing a relationship (often romantic or friendly) before luring them into fake cryptocurrency investments.

The Process to Be Wary of

These sophisticated operations typically unfold in stages:

- Initial Contact: Scammers cast a wide net, often starting with unsolicited messages on dating apps, social media, or even "wrong number" texts. They create convincing fake personas with attractive photos and fabricated backstories.

- Building Trust ("Fattening the Pig"): Over weeks or months, the scammer engages in regular, personal conversation, gradually building an emotional connection and gaining the victim's trust. They might discuss their own "success" in crypto investing, hinting at lucrative opportunities.

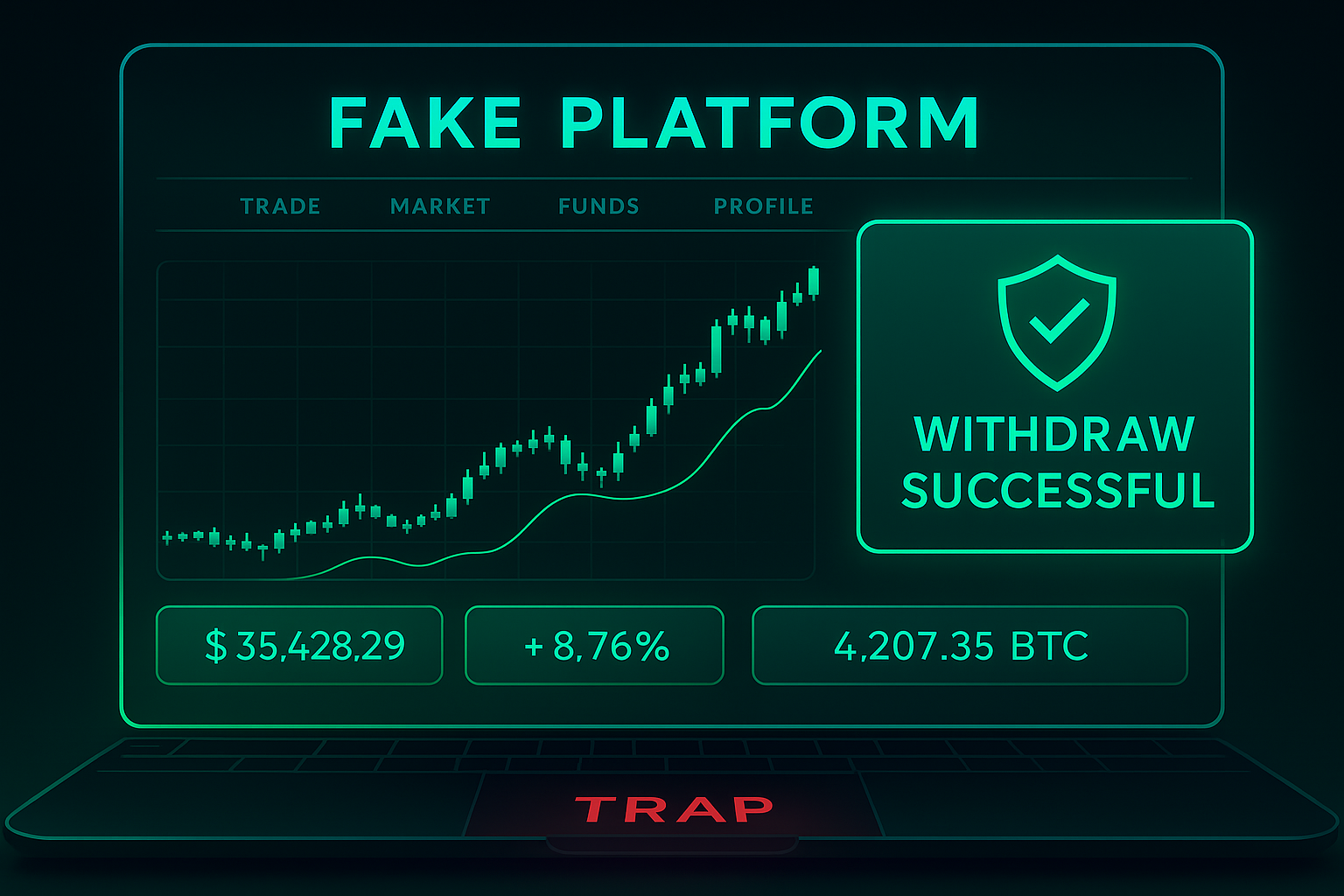

- The Investment Pitch: Once trust is established, the scammer introduces a seemingly exclusive crypto investment opportunity. They direct victims to sophisticated, yet entirely fraudulent, trading platforms that look legitimate, complete with fake charts and impressive, but false, returns.

- Initial "Profits" and Increasing Investment: To build confidence, scammers often allow victims to make small initial investments and even successfully withdraw a small "profit." This is a crucial step to convince the victim the platform is real and their money is safe, encouraging them to invest much larger sums, sometimes even taking out loans.

- The "Slaughter": Once the victim has invested significant amounts—draining their savings, retirement funds, or taking on debt—the scammer disappears, or the fake platform suddenly becomes inaccessible. Attempts to withdraw large sums are met with demands for additional "taxes" or "fees" that never lead to the return of funds, leaving the victim with devastating financial losses.

Many of these operations trace back to organized criminal networks operating from forced-labor "scam compounds" in Southeast Asia.

The Big Catch: How it Went Down

Coinbase played a key role in disrupting this particular network.

Their threat-intelligence team, working closely with federal agents and other exchanges like OKX and Tether, conducted an intensive investigation. By tracing on-chain transactions and analyzing account activity, Coinbase helped identify over 130 of its own customers who collectively lost $2.3 million to these scams.

Tether was also instrumental, freezing 39 wallet addresses containing the bulk of the $225 million in USDT, which was later burned and re-minted under Secret Service control. This collaborative effort allowed authorities to map the complex flow of illicit funds, leading to the massive seizure.

Why This Matters: A New Era of Collaboration

This case is a clear signal of growing maturity in the crypto space. The days when criminals could operate with near impunity are fading. Here's why.

- Public-Private Partnerships: This recovery highlights the power of exchanges like Coinbase working hand-in-hand with law enforcement. Centralized platforms possess the technical expertise and on-chain data analysis capabilities that government agencies alone may lack.

- Transparency for Tracking: While often criticized for privacy, the inherent transparency of public blockchains proved to be a powerful tool for investigators. Every transaction leaves a trail, allowing diligent teams to follow the money and build strong cases against perpetrators.

- Reinforcing Trust and Education: For the crypto industry to achieve broader mainstream adoption, trust is paramount. Successful operations like this one, which recover stolen funds and bring criminals to justice, not only contribute to that trust, but also aids in educating the public of what not to do.

Protecting Your Digital Assets: Tips for Staying Safe

While industry collaboration is improving, the first line of defense is always

you. Pig butchering scams, and many others, rely on social engineering.

Here are some tips to protecting your digital assets that you may find useful:

- Be Skeptical of Unsolicited Contact: Beware of messages from strangers on dating apps, social media, or even "wrong number" texts that quickly shift to discussing investments or a lavish lifestyle.

- Verify Everything: If someone you've only met online introduces you to an investment platform, research it independently. Check official websites, look for reviews, and be wary of promises of unusually high or guaranteed returns. If it sounds too good to be true, it almost certainly is.

- Never Send Crypto to Strangers: Do not send funds to anyone you haven't met in person or whose identity you cannot independently verify. Legitimate investment opportunities don't pressure you to move crypto to obscure, unfamiliar platforms.

- Secure Your Accounts: Always enable Two-Factor Authentication (2FA) on all your crypto accounts and use strong, unique passwords.

- Keep Records: If you believe you might have been a victim, keep detailed records of all communications, transaction IDs, and wallet addresses. This information is crucial for law enforcement. The Secret Service is currently encouraging victims to file claims with the FBI Internet Crime Complaint Center (IC3).

Looking Ahead: How Can the Industry Better Protect Users?

Beyond individual vigilance and reactive recoveries, the crypto industry is continuously evolving its proactive defense mechanisms:

- Improved User Education: Platforms are investing more in educating users about common scam tactics through alerts, guides, and public awareness campaigns.

- Standardization and Information Sharing: Greater collaboration among exchanges, blockchain analytics firms, and law enforcement agencies means faster identification and freezing of illicit funds across the ecosystem. This also includes sharing intelligence on new scam methodologies.

- Regulatory Clarity: As governments worldwide develop clearer regulatory frameworks for crypto, it encourages more robust compliance and security measures from exchanges, further empowering law enforcement.

A New Chapter for Crypto Security

The $225 million crypto recovery is more than a big number; it's a milestone. It highlights a maturing crypto landscape where sophisticated technology, determined law enforcement, and proactive industry players are increasingly uniting to combat financial crime.

While the digital frontier will always attract bad actors, cases like this reinforce a powerful message: the crypto world is becoming a safer place for legitimate users.

As collaboration strengthens and security measures advance, we move closer to a future where innovation can thrive without being overshadowed by the shadows of fraud. This is one step towards a more secure chapter for cryptocurrency and all who participate in it.